ESG

ESG

Governance Structure

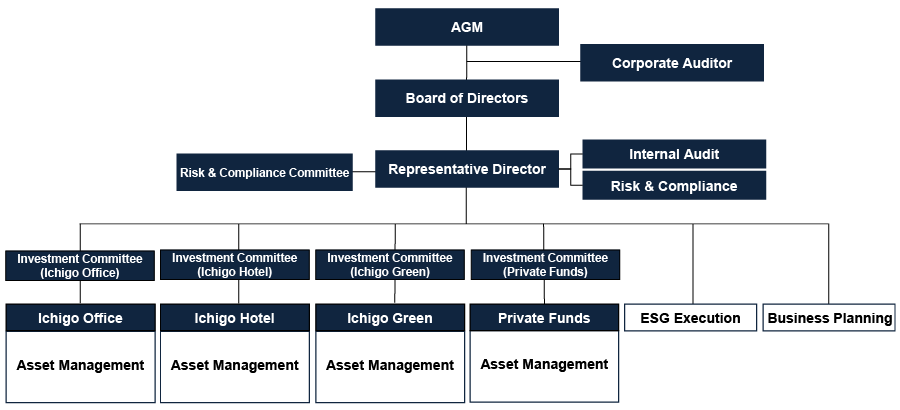

Ichigo Investment Advisors has adopted the Company with Board, Corporate Auditor, and External Auditor governance structure.

The Executive and Supervisory Directors of Ichigo’s three listed investment corporations are independent from Ichigo Investment Advisors and from the Ichigo group.

Asset management operations of Ichigo’s three listed investment vehicles are handled by separate business divisions, thus ensuring focused, optimal decision-making and solid information control.

Material investment decisions are made by the respective Investment Committees comprised of independent real estate appraisers, lawyers, and accountants.

IIA Organization Chart

Prevention of Conflicts of Interests

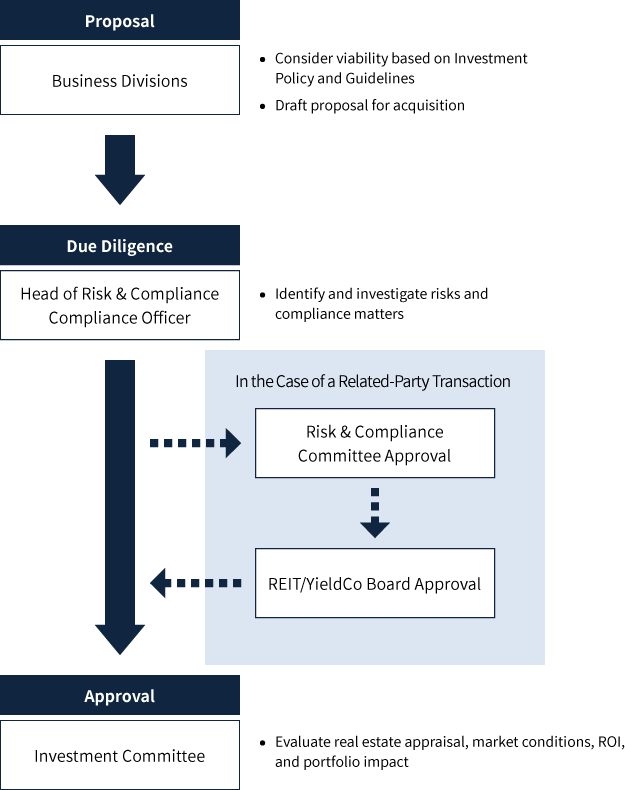

In order to prevent conflicts of interests when transacting with related parties, Ichigo has set a Policy for Managing Conflicts of Interest and Internal Rules for Related Party Transactions that require acquisitions from (sales to) related parties be made below (above) appraisal value as determined by an independent, third-party appraiser. Furthermore, acquisitions require that the Compliance Officer independently assess the transaction price by obtaining a second opinion appraisal and that the transaction be deliberated at the Risk & Compliance Committee (REIT and Solar Plant assets require board approval).

To eliminate conflicts between business divisions, internal rules require that asset acquisition information obtained by Ichigo Investment Advisors be mechanically distributed to business divisions based on an objective, pre-determined rules to ensure fairness and avoid any element of discretion.

Example of Related-Party Transaction Process(Acquisition from Ichigo Group)

Principles for Customer-Oriented Business Conduct

Ichigo has adopted the “Principles for Customer-Oriented Business Conduct” established by the Financial Services Agency (FSA) and has set its Policy for Customer-Oriented Business Conduct.

Related initiatives undertaken in the current year (Japanese only):

Compliance

Ichigo shares its Code of Corporate Ethics and Code Of Conduct with all Ichigo group companies and requires that all directors and employees of the Ichigo group explicitly confirm their adherence to these rules. Ichigo also has in place a whistle-blowing system by which any act of business that may be of concern from a compliance perspective can be escalated both through an internal hotline as well as through external legal counsel.

To assure appropriate business conduct, a Compliance Program is set by the Compliance Officer every fiscal year, with progress updates provided to the Board on a quarterly basis. Ichigo has also established internal rules with respect to the handling of legal and regulatory violations, requiring appropriate escalation, and mandating that the group head of the group making such violation appropriately handle the matter and further investigate causes and propose remediation plans to be validated by the Compliance Officer.